- 4 weeks ago

- 7Minutes

- 1223Words

- 52Views

Introduction

Managing finances can be overwhelming, but it’s crucial for a secure future. Saving money is a vital part of financial management. In this article, we’ll explore effective strategies to help you save more of your salary in India, with a little help from CommissionKart. By implementing these strategies, you can take control of your financial well-being and work towards achieving your financial goals.

Track Your Expenses

The first step towards saving more money is to understand where your money is going. Start by tracking your expenses for a month. This includes everything from your rent or mortgage payment to your daily cup of coffee. Use a budgeting app or create a spreadsheet to record your expenses. Categorize them into fixed expenses (such as rent or loan payments) and variable expenses (such as groceries or entertainment).

Analyzing your expenses will give you a clear picture of your spending habits. You may be surprised by how much you spend on certain items or activities. Identifying areas where you can cut back will help you save more money.

Set Clear Financial Goals

To effectively save money, you need to have clear financial goals. What are you saving for? It could be a down payment on a house, a dream vacation, or building an emergency fund. Whatever your goals may be, write them down and set a timeline for achieving them. Having specific goals will motivate you to save and make it easier to track your progress.

Create a Budget

Once you have a clear understanding of your expenses and financial goals, it’s time to create a budget. Here are some steps to help you get started:

- List Your Income Sources: Begin by identifying all your sources of income, including salary, freelance work, rental income, etc.

- Identify Fixed Expenses: Next, list down all your fixed expenses, such as rent or mortgage payments, insurance premiums, loan EMIs, etc.

- Subtract Fixed Expenses from Income: Deduct your fixed expenses from your total income to determine your discretionary income.

- Allocate Remaining Amount: Divide the remaining amount into different categories such as groceries, transportation, entertainment, savings, etc.

- Set Realistic Limits: Assign realistic limits to each category based on your financial goals and priorities.

- Track Your Spending: Keep track of your expenses regularly to ensure that you stay within your budget limits.

- Make Adjustments as Needed: Periodically review your budget and make adjustments as needed to accommodate any changes in your income or expenses.

By following these steps, you can create a budget that helps you effectively manage your finances and achieve your financial goals.

Stick to your budget by tracking your expenses regularly and making adjustments where necessary. A budget will provide you with a roadmap for managing your finances and ensure that you are saving a portion of your salary each month.

Reduce Unnecessary Spending

Reducing unnecessary spending is a key strategy for saving more money. Take a close look at your expenses and identify areas where you can cut back. For example, consider packing your lunch instead of eating out, canceling unused subscriptions, or buying generic brands instead of expensive name brands. Small changes in your spending habits can add up to significant savings over time.

Save Automatically

One of the most effective ways to save more money is to automate your savings. Set up an automatic transfer from your checking account to a separate savings account each month. This way, you won’t have to rely on willpower to save. Treat your savings like any other bill that needs to be paid, and make it a priority.

Use Discounts and Deals

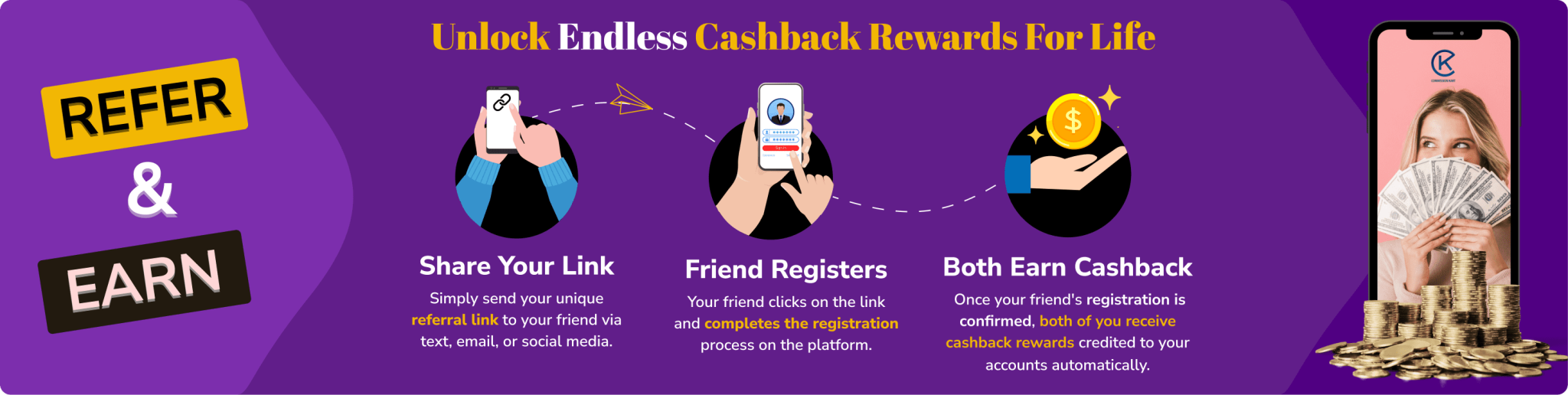

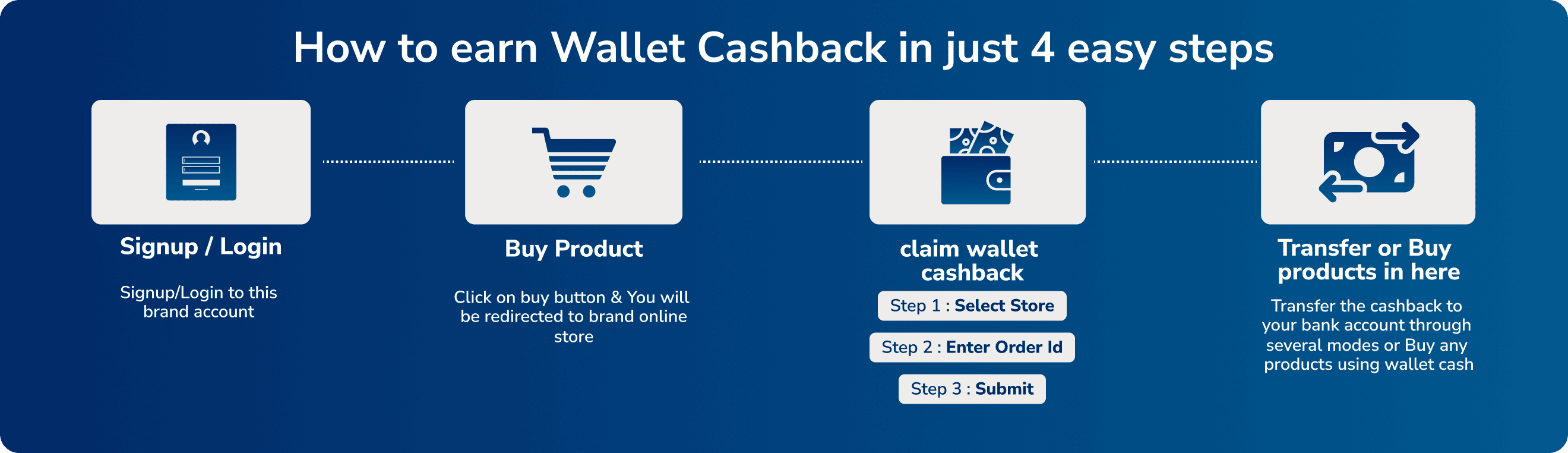

Take advantage of discounts and deals to save money on your everyday expenses. Look for coupons, loyalty programs, and special offers when shopping for groceries, clothing, or other items. Compare prices before making a purchase and consider buying in bulk to save even more. By being a savvy shopper, you can stretch your salary further and increase your savings. Platforms like CommissionKart offer deals on a wide range of products from over 1000 websites, including major e-commerce players like Amazon, Reliance Digital, and TataCLiQ. In addition to discounts, CommissionKart also offers extra cashback on your purchases. This savvy shopping approach could potentially offer the same products at a reduced price.

Pay Yourself First

When you receive your salary, make it a habit to pay yourself first. Set aside a portion of your income for savings before paying your bills or other expenses. This ensures that you prioritize your savings and prevents you from spending all of your income. Aim to save at least 20% of your salary, but even saving a smaller percentage is better than not saving at all.

Plan for Emergencies

Life is unpredictable, and having an emergency fund is crucial for financial security. Set aside a portion of your savings for emergencies such as medical expenses or unexpected car repairs. Aim to have at least three to six months’ worth of living expenses saved in your emergency fund. Start small and gradually build up your fund over time.

Invest Wisely

Saving money is important, but so is making your money work for you. Explore investment options that align with your risk tolerance and financial goals. Consider investing in mutual funds, stocks, or fixed deposits. It’s important to do your research and seek professional advice before making any investment decisions. Investing wisely can help grow your savings and accelerate your path towards financial freedom.

Review and Adjust Regularly

Financial management is an ongoing process. Regularly review your budget, expenses, and savings to ensure that you are on track towards achieving your financial goals. Make adjustments as needed to reflect changes in your income or expenses. Stay vigilant and proactive in managing your finances to maximize your savings potential.

Seek Professional Advice

If you find yourself struggling to manage your finances or need guidance on investment options, consider seeking professional advice. A financial advisor can provide personalized recommendations based on your financial situation and goals. They can help you create a comprehensive financial plan and ensure that you are making the most of your salary.

Stay Motivated

Saving money requires discipline and motivation. Keep reminding yourself of your financial goals and the benefits of saving. Celebrate small milestones along the way to stay motivated. Reward yourself when you achieve a savings goal or reach a significant milestone. By staying motivated, you will be more likely to stick to your savings plan and achieve financial success.

Celebrate Milestones

Achieving financial milestones is an accomplishment worth celebrating. When you reach a significant savings goal or achieve a milestone in your financial journey, take the time to celebrate your achievements. Treat yourself to a small indulgence or do something special to reward yourself for your hard work and dedication. Celebrating milestones will help you stay motivated and continue on your path to financial success.

Conclusion

Saving more of your salary in India is a journey that requires planning, discipline, and perseverance. By implementing the strategies outlined in this article, you can take control of your finances and work towards achieving your financial goals. Remember to track your expenses, set clear financial goals, create a budget, reduce unnecessary spending, save automatically, and seek professional advice when needed. Stay motivated, celebrate milestones, and review and adjust your financial plan regularly. With dedication and commitment, you can master your finances and secure a brighter future.